Homeowners Insurance in and around Smithville

Looking for homeowners insurance in Smithville?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

Homeownership is a lot of responsibility. You want to make sure your home and the possessions in it are protected in the event of some unexpected loss or damage. And you also want to be sure you have liability insurance in case someone stumbles and falls on your property.

Looking for homeowners insurance in Smithville?

The key to great homeowners insurance.

Don't Sweat The Small Stuff, We've Got You Covered.

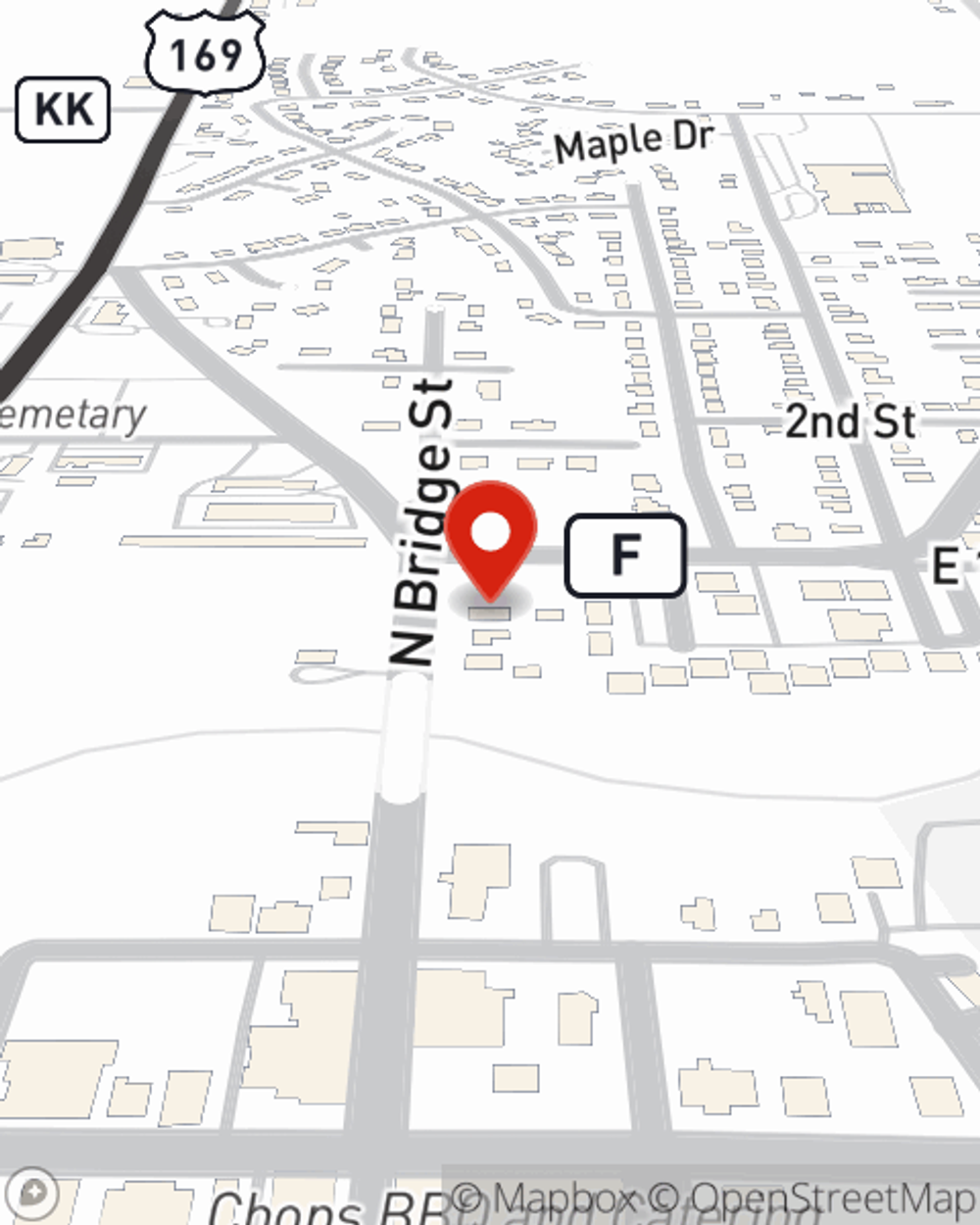

State Farm Agent Cyndi Davidson is ready to help you handle the unexpected with dependable coverage for your home insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Cyndi Davidson can help you submit your claim. Find your home sweet home with State Farm!

Now that you're convinced that State Farm homeowners insurance should be your next move, reach out to Cyndi Davidson today to get started!

Have More Questions About Homeowners Insurance?

Call Cyndi at (816) 532-0627 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Flood insurance: What to know

Flood insurance: What to know

Learn the essentials of flood insurance and why it’s important for protecting against one of the costliest natural disasters in the United States.

Cyndi Davidson

State Farm® Insurance AgentSimple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Flood insurance: What to know

Flood insurance: What to know

Learn the essentials of flood insurance and why it’s important for protecting against one of the costliest natural disasters in the United States.